In Australia, the debate over board tenure versus turnover is heating up as the Australian Prudential Regulation Authority (APRA) proposes a 10-year lifetime tenure limit for non-executive directors. This article explores the balance between maintaining corporate memory and bringing in fresh perspectives, examining global practices and their implications for Australian organisations.

Term Limits

Why care about a director's tenure? APRA clearly does.

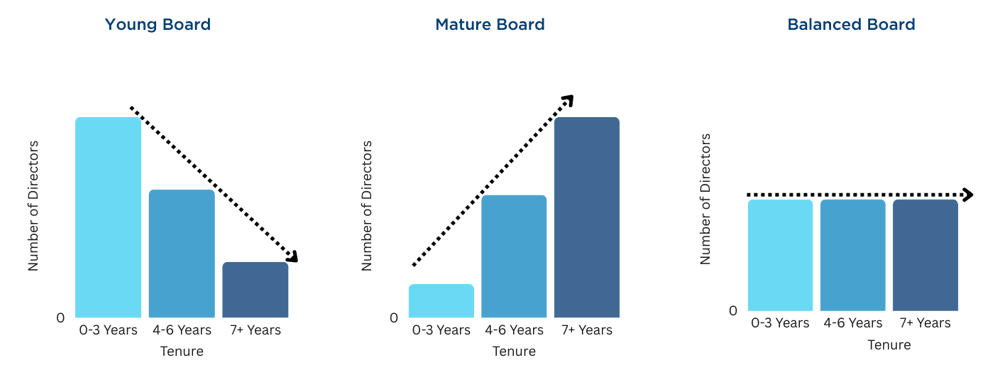

Yes, tenure profile represents the balance between maintaining corporate memory and bringing in fresh perspectives, but is there a correlation between organisational performance and any tenure profile – young, mature, or balanced?

In looking for evidence to answer this question, we concede it is difficult to answer. Often, the circumstances that drive organisational performance are impossible to decouple from the tenure profile of its directors, and we suspect it would be futile to try. Perhaps there is a PhD in this for someone?

Rather, we acknowledge this is more a question of the independence of boards – and at what stage do directors lose their independence?

In the S&P 500, 56% of companies with a tenure policy currently require board members to step down after 15 years of service, and 25% set the term limit at 12 years.

When asking our colleagues around the world for their thoughts, we noted that in Ireland, financial institutions have a maximum tenure of nine years (3x3), although there is a groundswell of opinion that it should be 6 years maximum, as after that “you cease to be independent”.

Colleagues in London have been conducting board governance reviews for well over 20 years, and the UK and parts of Europe are ahead of the curve in driving best practice around independence in the context of a ‘healthy’ tenure profile. The UK Corporate Governance Code sets no explicit tenure limit for non-executive directors, but the Code suggests that after nine years of service, their independence might be questioned, effectively acting as a de facto tenure limit.

In Canada, most public sector boards have mandatory terms that are typically 6 years. In some cases, there are nine-year terms, but that is the limit. However, in listed and private companies, there are often no stated term limits, although proxy advisors such as Glass Lewis and ISS are increasingly advocating a limit of 12 years, but that is not being widely adopted.

In Australia, the percentage of organisations establishing director term limits (mandatory retirement policies based on tenure) is growing, albeit slowly. When looking at data for the ASX300, we note that nearly 30% of all organisations have at least two directors with a tenure of 9 years or more, and over 16% have at least two directors with a tenure of over 12 years (source – OpenDirector).

What are the implications for all Australian organisations if Australia adopts the approaches of other countries, with tenure limits of 9 years or even 6 years imposed?

The Harvard Business Review highlights the pitfalls of tenure restrictions and the importance of having long-serving directors who can add significant value. They also point out that average tenure is a crude measure because it misses the important point that “even a single long-serving director can add tremendous value without compromising the board’s overall independence.”

Organisations should take a long-term approach to board composition, ensuring that the board has critical core competencies for long-term performance regardless of the challenges of the day.

Accordingly, boards need memory. Turnover for the sake of turnover is imprudent and needs to be considered in the context of where the organisation is coming from and where it is likely heading.

Instead of recruiting directors only as vacancies arise, organisations should also look ahead several years for potential vacancies (not just the evolving needs of the organisation and current board effectiveness). This will “depersonalise” succession planning and ensure that the board is able to evolve to meet the company’s needs. It also offers boards the flexibility to retain valuable directors.

_____________________________________________________

Get in touch. Discover more about our board practice and how we can assist your organisation in achieving optimal board composition, contact our dedicated leadership experts from your local Odgers Berndtson office.

Never miss an issue

Subscribe to our global magazine to hear our latest insights, opinions and featured articles.

Follow us

Join us on our social media channels and see how we're addressing today's biggest issues.