Securing funding is a crucial step for any business, varying significantly depending on its life stage—from Pre-seed to Series B and beyond. Our experts explore how venture capital (VC) and private equity (PE) funding, would be unicorns.

Let's start by clarifying the two types of funding. Private equity (PE) firms usually target mature businesses, acquiring substantial or full control. In contrast, venture capital (VC) firms invest in early-stage or emerging companies with high growth potential. The VC investment model is a structured process, typically unfolding as follows:

A founder develops a compelling idea and leads a business seeking funding. They approach VC firms with their business plan, pitch, and financial projections. The VC firm evaluates the business idea, market potential, team potential, and growth prospects. If interested, the VC firm proceeds to conduct due diligence on the business.

Due diligence involves both objective and subjective assessments. Objectively, it examines the start-up's financials, market dynamics, competitive landscape, and team capabilities. Subjectively, it evaluates the founders themselves. This phase aims to assess the business's overall viability. The VC team interviews and gets to know the founders, making a judgement call on their leadership potential, energy levels, decision-making speed and quality, and founder likeability—a crucial factor in recruiting and scaling. The VC firms may also explore the founders' ability to create a culture of radical candour, where employees feel respected, cared for, and empowered to challenge the work of those around them. In essence, can the founders build a healthy, vibrant workplace?

It’s not beyond the realm of possibility for us to reject a business because the founder wasn’t particularly likeable.

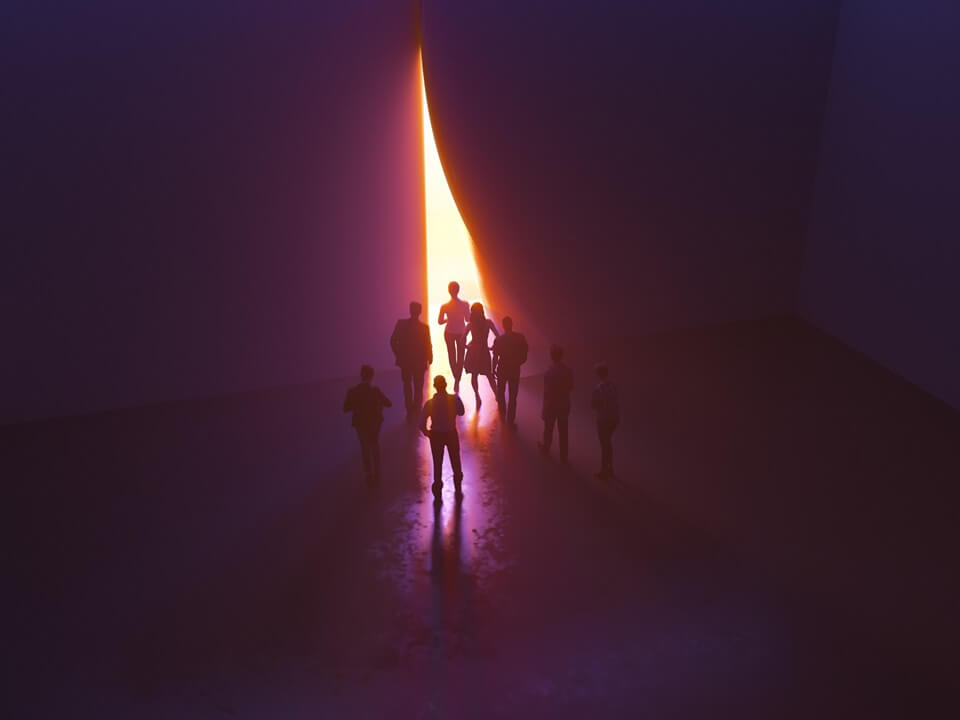

If this proceeds favourably, the VC firm will present a term sheet to the founders, outlining the investment terms and conditions, including the amount they are willing to invest, company valuation, equity stake, etc. Once agreed upon, the firm may release all or part of the funds to the business, allowing the founders to build the next unicorn (a privately held start-up valued at over $1 billion). Approximately 2.5% will achieve this mythical status. But what happens to the remaining 97.5%?

We are seeing a trend of VCs offering founders and their teams leadership development, which may include executive assessments and coaching. VCs win as they are assured their investments have leaders who are more self-aware and evolving as the needs of the business grow.

Around 60% of these businesses will fail between seed and Series A funding stages, with a staggering 80% of all tech and e-commerce businesses failing during these stages. Depending on who is consulted, the number of failures might be as high as 90%, with 20% of all start-ups failing in their first year of operations alone, 50% by the second year, and 75% by the close of the third year. Approximately 35% of start-ups will fail between Series A and B funding.

These statistics are based on averages, and individual start-up outcomes can vary significantly. While factors such as market conditions, team dynamics, product-market fit, and execution play crucial roles in determining a start-up's fate, one factor influencing start-up and scale-up failure, perhaps more than many others, is leadership, or to put it bluntly, leadership breakdown.

In 2023, Australian start-ups received a total of $3.5 billion in funding across 413 reported deals. Despite the impressive sound of this figure, it represents a decline from the $7.4 billion in funding received in 2022, a 53% decrease. As many of these businesses shift their priority from growth to profitability at all costs, it seems clear that leadership effectiveness and development will become even more critical success factors as VC (and PE firms) look to de-risk their investments and help founder teams succeed in an increasingly competitive market.

Looking regionally, Singapore remains a magnet for venture capital in Southeast Asia. Its stable political climate and robust economy attract substantial investments, providing entrepreneurs access to a larger pool of funds for business expansion and development. Notable developments include Warrantee, a Japanese start-up offering free insurance services in the US and Singapore, which has publicly filed for its initial public offering (IPO) on NASDAQ. Additionally, Cashi Cake, a Los Angeles-based start-up behind D2C-focused Japanese confectionery brands, secured ¥120 million (about $1 million) in the first tranche of its seed round.

Japan’s venture capital landscape is evolving, although it faces challenges. In 2022, China and India outpaced Japan in attracting venture capital funding. However, Japan boasts active investors and a vibrant start-up ecosystem. The Japan VC Radar highlights the most active VC funds in the country, with independent VC funds actively investing in start-ups. While Singapore continues to shine, Japan is making strides, offering unique opportunities for entrepreneurs and investors alike.

As companies grow, new challenges arise in leadership and team dynamics. Growth often leads to role shifts, skill gaps, and scaling difficulties. Effective leaders must transition from hands-on roles to strategic oversight, navigate cultural integration, and adapt decision-making processes. Failure to address these shifts can result in leadership breakdowns, a significant contributor to start-up failure.

Here are seven reasons why leadership breakdowns occur during this process:

- Role Shifts and Skill Gaps: In the early stages of a start-up, founders often wear multiple hats and take on various responsibilities. As the company grows, specialised roles emerge, and leaders must adapt. Some founders struggle to transition from being hands-on doers to strategic leaders. They may lack the skills needed to manage larger teams or navigate complex organisational challenges.

- Scaling Challenges: Rapid growth can strain existing processes, systems, and structures. Leaders who were effective in a small team may struggle to manage larger teams or coordinate across different functions. Scaling requires leaders to rethink how they delegate, communicate, and make decisions.

- Culture and Communication: Start-ups often have a unique culture driven by the founder’s vision and values. As the company scales, maintaining that culture becomes challenging. Leaders must ensure that everyone is committed to the company’s unique culture and that communication remains effective across all levels.

- Decision-Making Complexity: In a small start-up, decisions are made quickly, and founders have a direct line of sight into everything. As the organisation grows, decision-making becomes more complex. Leaders must balance data-driven decision-making with agility and adaptability.

- Founder-CEO Transition: Many start-ups face a leadership transition when the founder-CEO steps aside to bring in a professional CEO. This shift can be difficult for both the founder and the new leader. The founder may struggle with relinquishing control, while the new CEO faces the challenge of aligning with the existing team and culture.

- Leadership Development: Start-ups often prioritise growth over leadership development. As a result, leaders may not receive adequate training or support to handle the demands of a larger organisation. Investing in leadership development becomes crucial during scaling.

- Team Dynamics: As teams expand, interpersonal dynamics change. Cliques, power struggles, and conflicts can emerge. Leaders must actively manage team dynamics and foster collaboration.

According to Harvard Business School Professor Noam Wasserman, 65% of high-potential start-ups fail due to co-founder conflict. While specific data on the broader leadership issues that result in a start-up failing is not readily available, feedback from the sector suggests that up to 20% of start-ups will fail because of team problems and other people-related issues. Due to the complexity and lack of data surrounding leadership, it is estimated that this number may be closer to 50%.

Leadership sustainability is critical to start-ups' success in a rapidly evolving investment landscape. As founders navigate the transition from initial growth to scaling, the ability to adapt, maintain a cohesive culture, and develop strategic leadership skills becomes indispensable.

Both VC and PE investors are increasingly recognising the importance of leadership effectiveness in de-risking their investments and guiding start-ups towards achieving unicorn status. By prioritising leadership development and fostering a supportive work environment, start-ups can survive the tumultuous early stages, thrive, and succeed in the competitive market.

__________________________________________________

Get in touch. Follow the links below to discover more, or contact our dedicated leadership experts from your local Odgers Berndtson office here.

Never miss an issue

Subscribe to our global magazine to hear our latest insights, opinions and featured articles.

Follow us

Join us on our social media channels and see how we're addressing today's biggest issues.